STRATEGIES FOR ENSURING POST-M&A SUCCESS

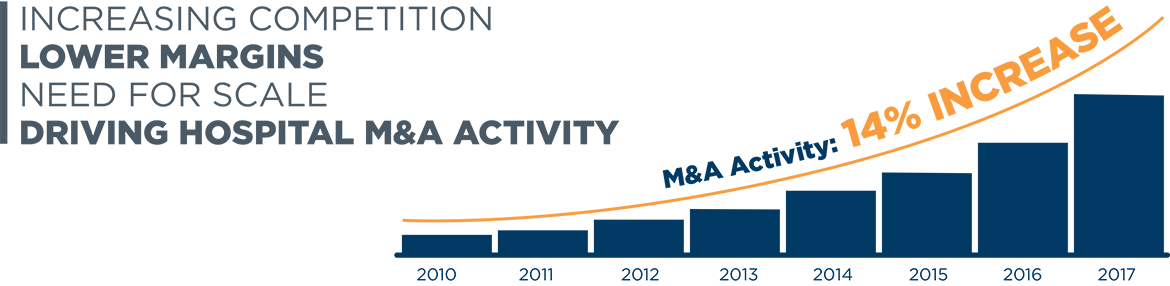

Key Market Trends

Waves of Change Driven by Economics

Continued Growth in Consolidation

Three Primary M&A Strategies Emerge

Collaborative

Partnerships

Hospitals and health systems remain independent, but create legal partnerships that allow them to pursue common goals and mitigate financial and clinical risks.

Affiliate

Partnerships

Hospitals combine with each other — or even health plans and specialty clinics — to pursue joint ventures. Primarily designed to improve performance of value-based care, data analytics and population health management.

Full-asset Mergers and Acquisitions

The most commonly pursued approach is to merge or buy peer organizations that have complementary capabilities, market reach and brand reputations. This strategy typically provides the quickest path to financial gains — if the integration progresses smoothly.

How Can Hospitals Improve Post-M&A Integrations and Outcomes?

Immediately Bridge Previously Siloed Departments

Success in the emerging value-based environment will require a detailed understanding and measurement of various processes across the hospital — especially in patient care areas. Most hospitals today do not have the visibility to accomplish this, largely because of silos between areas such as nursing, supply chain and clinical engineering. The problem is compounded when trying to standardize service across the disparate processes of two merging organizations — from patient care to equipment management — and it can generate significant waste.

Key concept: Ensure all process-standardization efforts engage team leaders across nursing, supply chain and clinical engineering. By leveraging best practices to re-engineer equipment processes, you can ensure internal teams have the transparency, visibility and control they need to better manage costly equipment rentals and capital purchases.

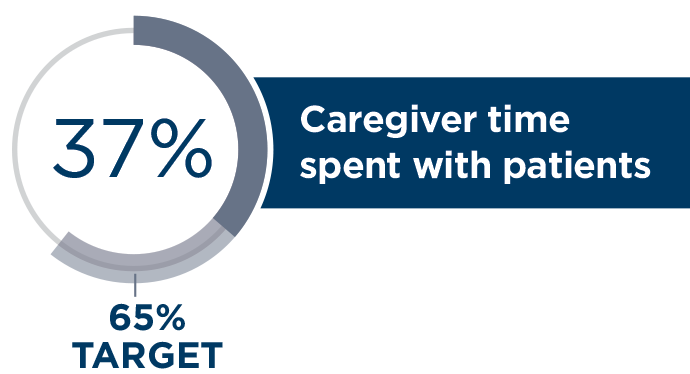

Empower Clinicians to Focus on What Matters Most

Because hospitals will be graded largely on patient satisfaction and quality of outcomes in the value-based reimbursement era, a key to success will be talent retention. Hospitals with the best clinical talent will likely build the best reputations and earn the highest reimbursement scores. Retaining top talent through the M&A process is critical, as broken processes and working environment challenges can prompt talented nurses to look elsewhere for employment.

Key concept: Focus on increasing the amount of time nurses spend at the patient bedside by eliminating unproductive and non-value added tasks. For example, by eliminating the need for them to search for infusion pumps, beds and ventilators, you can increase both face-time with patients and job satisfaction. Ensure these processes are ready to go from day one of the integration phase.

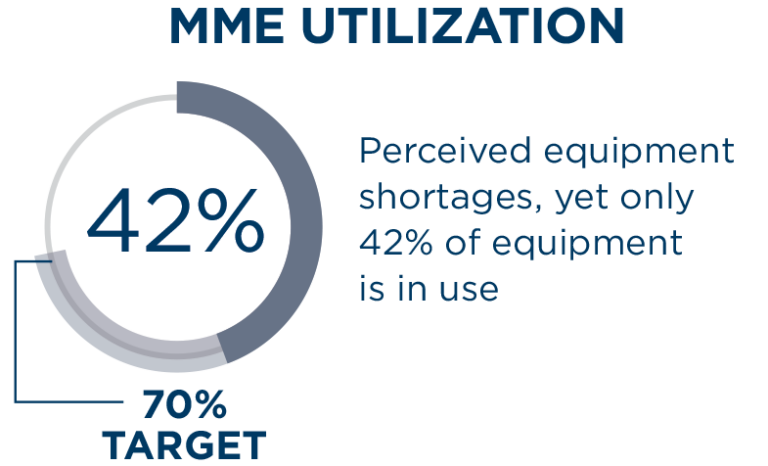

Target “Low-Hanging” Cost Reductions to Jumpstart Savings

Key concept: During the M&A process, conduct a study on equipment utilization, spending and management of mobile medical equipment. Consider leveraging end-to-end equipment management services and deploy best-practice-based processes in the first year after the deal closes.

Other Insights and Resources

Elevate Your Team – Improve Your Hospital